The cost of buying residential property in Uganda has gone up sharply, according to new figures released by the Uganda Bureau of Statistics (UBOS).

UBOS says prices for houses and residential property increased by 9.2 percent in the year ending the second quarter of the 2025/2026 financial year. This is nearly double the 4.7 percent increase recorded in the previous quarter.

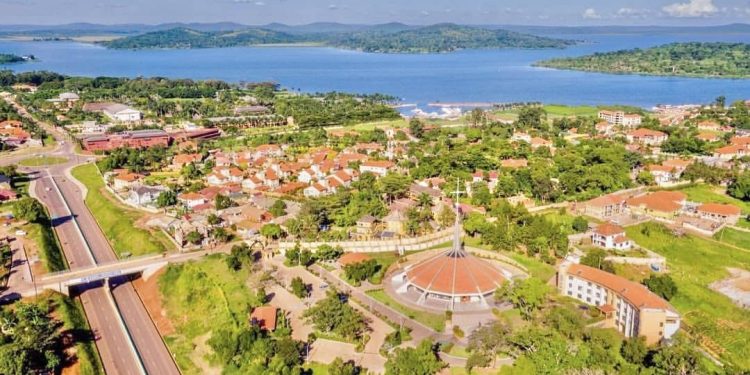

In simple terms, this means houses are becoming more expensive much faster than before, especially in and around Kampala. This is according to the Residential Property Price Index (RPPI) Q2 2025/26.

Wakiso Still the Most Expensive Area

Wakiso District recorded the highest increase in property prices, with costs rising by 16.9 percent. Although this is slightly lower than the 18.3 percent recorded earlier, Wakiso remains the most expensive area for home buyers.

Many people are moving to Wakiso due to the limited land in Kampala city, pushing prices higher.

Prices Rise Again in Kampala Central

After months of falling prices, Kampala Central and Makindye saw a turnaround. Property prices in these areas increased by 2 percent, compared to a sharp 10.2 percent drop in the previous quarter.

This suggests demand for property in central Kampala is slowly recovering.

Other Areas Also See Increases

Kawempe and Rubaga recorded a 9.5 percent increase, up from 6.4 percent earlier.

Nakawa saw prices rise by 5.8 percent, although this was lower than the previous 7.8 percent increase.

Overall, UBOS says rising demand for housing, especially in Greater Kampala, is driving prices up.

Average Property Prices Also Higher in 2025

Looking at the full calendar year, UBOS reports that average residential property inflation in 2025 stood at 5.6 percent, up from 4.6 percent in 2024.

Wakiso again led with the highest increase at 11.6 percent, compared to just 2.1 percent last year. Kawempe and Rubaga followed at 7.8 percent, while Nakawa recorded 6.2 percent.

However, Kampala Central and Makindye were an exception, where prices fell by 2.2 percent in 2025, compared to a strong rise in 2024.

Prices Still Rising Quarter by Quarter

UBOS also found that property prices continued to rise between the first and second quarters of the 2025/2026 financial year.

Overall prices went up by 2.6 percent in the second quarter. The biggest quarterly increases were seen in: Nakawa – up by 5.7 percent, Kampala Central and Makindye – up by 4.6 percent and Kawempe and Rubaga – up by 2.7 percent.

Population Growth & Urbanisation: Uganda’s young, growing population and movement to cities like Kampala increase demand for housing and land.

Infrastructure Projects: Major developments (expressways, airports) boost connectivity and property values in surrounding areas.

Foreign Investment: Inflows from foreign investors fund large-scale projects, raising standards and prices.

Economic Factors: General economic growth and policies supporting real estate contribute to upward pressure.

What This Means for Ugandans

For ordinary Ugandans, the UBOS report means: buying a house is becoming more expensive, rent is likely to increase as landlords adjust to higher property values, and people looking for affordable housing may be pushed further out of Kampala.

UBOS Executive Director Dr Chris Mukiza said the figures reflect strong demand for housing, especially in urban and peri-urban areas.

The Ugandan real estate market shows upward pressure on prices, especially for land and housing in urbanising areas, fueled by demographic shifts and development, making it a growing, though geographically varied, market.