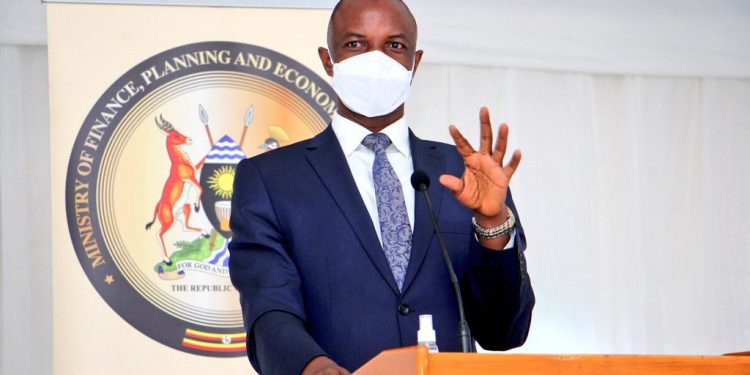

The Permanent Secretary and Secretary to the Treasury (PS/ST) Ramathan Ggoobi has assured Ugandans in the diaspora that government of Uganda has no intention of taking over or even taxing unclaimed balances in Bank Accounts or Mobile Money Accounts.

Ggoobi said the legal framework which manages the financial system was designed to protect owners of money saying rumors that the money is needed by government to pay its debt is false.

“Rumors that money is needed by Government of Uganda to pay its debt is false, Uganda is among the few Sub-Saharan Africa Countries with a sustainable debt portfolio. I encourage Ugandans in the diaspora to come & invest at home & take advantage of available opportunities”

Ggoobi made the remarks while addressing members of The Uganda North American Association (UNAA) an organization that brings together Ugandans who live in the diaspora.

This follows media reports that the Ugandan government plans to take depositors idle cash on dormant bank accounts under the National Payment System Act and that upon implementation, huge accounts holders are likely to lose what government has announced as “Idle Money” in bank accounts.

The Uganda Bankers Association (UBA) in a press statement issued on September 16, said the National Payment System Act regulates payment systems, provides for safety and efficiency of payment systems, regulates payment service providers.

“In the Act under section 57, Sub Section (1) it is stated that an electronic money account t that do not have a registered transaction for nine consecutive months will be considered Dormant, this account could be a mobile money account or a bank account,” UBA noted.

UBA says the practice of transferring balances on dormant accounts to the central bank unclaimed balances account is standard practice that has been in existence already and not new.

For bank accounts the period of declaration of dormancy is two years and the period for declaration assets as unclaimed after dormancy, is eight years meaning a customer has up to 10 years to reclaim their balances after dormancy.

UBA said as a sector, they believe that the Enactment of The National Payment System Act, 2020 will bring about more positive changes in the payment space.