“When ESG becomes the vehicle you use to drive sustainability, that is when your business begins to thrive,” said Pieter Scholtz, Partner- ESG Lead Africa at KPMG.

Pieter was Thursday speaking during a panel discussion on “ESG or Sustainability: How are the two different and what makes sense for Uganda?” at the ACCA Uganda Members’ Convention 2024 held at Speke Resort Munyonyo.

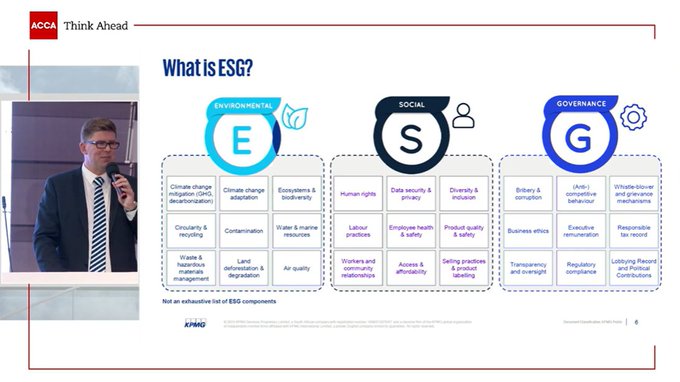

Environmental, social, and governance (ESG) is shorthand for an investing principle that prioritizes environmental issues, social issues, and corporate governance.

“Corporates need to plan to prepare for structural change and climate impacts. If businesses think about ESG as compliance, then it becomes a cost exercise,” said Pieter.

According to him, ESG and Sustainability are not different. “The sustainability element is why we are focusing on this ESG agenda. We are doing it to look after ourselves and our children.”

He said more than two-thirds of CEOs do not believe that their companies will be able to meet their 2030 net zero commitments as a result of; the cost of decarbonization, lack of appropriate technology to gather and analyze data, and lack of skills and expertise to successfully implement solutions.

“Greenwashing is when we claim sustainability performance or credit that we don’t necessarily have. So, we say this product of ours is carbon neutral but actually, what we haven’t calculated is the carbon coming from transportation. The other one is simply a lie because it makes us look better. This is where you (finance professionals) will play a key role. All the reports will have to follow standard audit processes with input from auditors, finance professionals, and subject matter experts,” he added.

He quoted the later Nelson Mandela saying, “Sometimes it falls upon a generation to be great, you can be that great generation. Of course the task will not be easy but not to do this would be a crime against humanity”.

According to Pieter, research shows that demand for sustainability-linked products increases by 5% more than non- sustainability-linked products. “You can use that to grow your topline.”

How ESG can unlock shareholder value

Speaking during a panel on “Best practice and impact on how ESG can unlock shareholder value”, Irene Nayera, Organization, and Human Resource Director at Hima Cement, said that in 2018, the company decided to adopt a gender-inclusive fleet and introduced women into our supply chain operations.

“Most of the women that took over this market were Kenyans. We started with 3 women who got training and licenses and were thriving. These women proved that we’re able to save over 1000 liters of fuel and can safely drive on the road which reduces road accidents.”

She added: “We are proud that 64% of our tracks are driven by women. We have experienced a quicker turnaround time. The male counterparts have now been able to pick up the pace. UNDP is now partnering with us to train more women to join our program.”

Ann Marie Mwaka Sabano, Head of Business Development aBi Trust & Finance, said: “You need to understand your “why”. Once you do, you will be able to know the framework to use. Then also focus on your “what” and the “where” will the information come from. And while at it, automate as much as possible.”

She said there has to be standardization and it has to be continuous. “There is a “who” is going to be responsible and is collecting the data, reporting and validating it.”

According to her, ESG strategy doesn’t have to be one document; it should be departmentalized.

“On structure, there has to be champions at every level championing the agenda. We have to be intentional about skilling. On leadership, we have to set the tone from the top and we have to have shared values and set it as our culture.”

David Kiyingi Nyimbwa, Head Sustainable Public Procurement Unit at the Ministry of Finance, asked the private sector to move away from unsustainable practices.