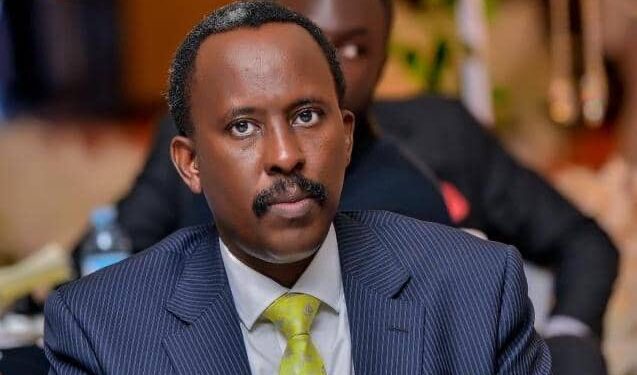

The Uganda Revenue Authority (URA) has broadened its electronic tax compliance drive by requiring 12 additional business sectors to adopt its Electronic Fiscal Receipting and Invoicing Solution (EFRIS), effective July 1, 2025. This directive, issued by Commissioner General John R. Musinguzi under the Tax Procedures Code Act and the E-Invoicing and E-Receipting Regulations of 2020, aims to ensure businesses issue authenticated e-invoices and receipts.

The new sectors now affected include wholesale and retail of fuel; mining and quarrying; manufacturing; electricity, gas, steam, and air-conditioning supply; water supply, sewerage, waste management, and remediation; construction; transportation and storage; accommodation and food services; information and communication technology; real estate; professional, scientific, and technical activities; and arts, entertainment, and recreation.

URA highlights that EFRIS, first introduced in 2021, is designed to curb tax evasion by enabling real-time transaction reporting. This expansion targets industries historically prone to under-reporting while fostering transparency and fair competition among taxpayers.

All businesses in the newly included sectors are urged to register for EFRIS or adopt URA-approved systems. Non-compliance may result in penalties, including fines of up to double the tax due on the affected goods or services.