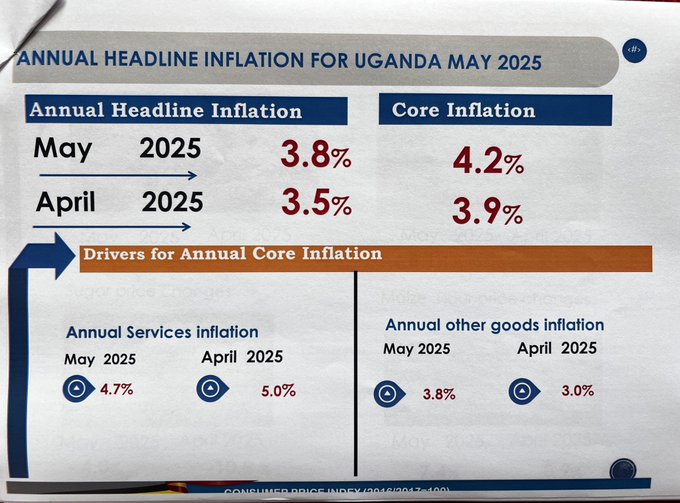

The Uganda Bureau of Statistics (UBOS) has reported that the annual headline inflation for the year ending May 2025 stands at 3.8%, with core inflation recorded at 4.2%.

The rise was largely driven by increases in services inflation and other goods inflation, the national statistics body said.

Meat Prices: Rains Reduce Urgency to Sell Livestock

UBOS noted that meat prices have been affected by changing weather patterns. During the recent dry spell, the scarcity of water and pasture forced many livestock farmers to sell off animals, leading to earlier price stabilisation.

However, with the return of rains, farmers now have adequate water and grass, reducing the urgency to sell and leading to a lower market supply. Additionally, animal exports to neighbouring countries have tightened domestic availability.

Matooke Price Surge Tied to Seasonality

The spike in matooke prices is attributed to seasonal changes. UBOS explained that much of the produce from the previous season has been sold off or dried, while newly planted crops are not yet ready for harvest. This has created a temporary supply gap, impacting the prices of other food crops like sweet potatoes, dry beans, and cabbages.

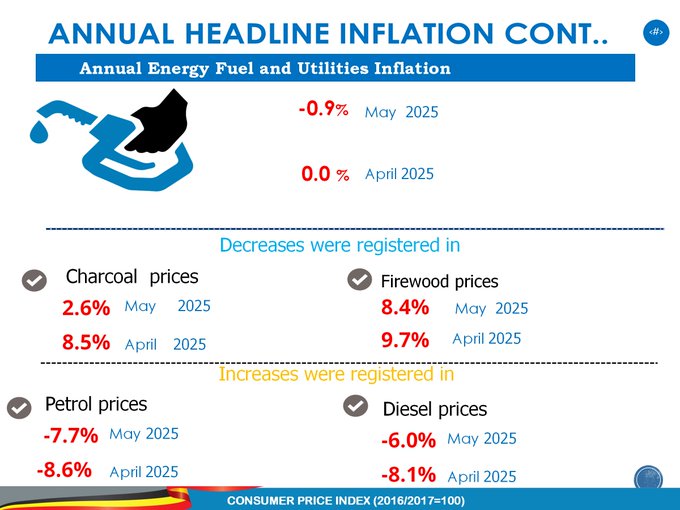

Energy and Utilities: Mixed Trends

A slowdown in the rate of change for energy, fuel, and utilities contributed to moderating overall inflation. While charcoal and firewood recorded price drops, petrol and diesel prices rose during the period, adding mixed pressure to household expenditures.

Inflation by Region

Among the regions surveyed, Masaka recorded the highest annual inflation at 5.3%, Kampala High-Income area followed at 4.8%, and the lowest inflation was reported in Mbale, at just 0.5%.

Monthly Inflation Steady at 0.5%

On a month-to-month basis, monthly inflation for May 2025 was recorded at 0.5%, unchanged from April 2025. This stability reflects offsetting movements in prices for food items and fuels. Increases were noted for matooke, dry beans, sweet potatoes, and cabbages, along with upward shifts in petrol, diesel, and firewood prices.

UBOS continues to monitor the trends closely as the country moves through changing climatic conditions and external economic pressures.