Uganda Development Bank Ltd (UDB), the country’s national Development Finance Institution, has released its 2024 performance results, showcasing a year of solid financial growth, impactful development outcomes, and sustained institutional progress.

The announcement was made during the Bank’s Annual General Meeting held at the Ministry of Finance, Planning and Economic Development in Kampala. The report highlights UDB’s growing role in Uganda’s economic transformation, with a focus on fostering private sector development, industrialisation, and inclusive growth across the country.

Financial Performance and Institutional Growth

In 2024, UDB recorded a net profit of UGX 57.8 billion, representing a 16% increase from UGX 49.8 billion in 2023. This performance was driven by prudent cost management and strategic investment in interest-earning assets.

Total assets grew by 7%, reaching UGX 1.78 trillion, up from UGX 1.67 trillion in 2023, supported by retained earnings and UGX 80.7 billion in capital contributions from the Government of Uganda. The loan portfolio also expanded, with net loans and advances rising by 9% to UGX 1.53 trillion.

UDB Managing Director, Dr Patricia Ojangole, attributed the growth to the Bank’s ongoing transformation and strategic investment in key development sectors: “UDB remains a steadfast partner in Uganda’s development journey. We continue to channel resources into productive enterprises across agriculture, manufacturing, and services, aligning with national priorities and enabling long-term economic impact.”

To support asset growth, the Bank reinvested UGX 437 billion in loan repayments and increased its capitalisation to UGX 1.46 trillion, enhancing its lending capacity.

Stimulating Private Sector Growth

In 2024, UDB approved UGX 454 billion in new loans to over 170 enterprises in 67 districts, with these investments projected to generate: 17,832 new jobs, UGX 9.7 trillion in additional output, UGX 1.8 trillion in foreign exchange earnings, UGX 1.7 trillion in profits and UGX 455 billion in tax contributions.

Additionally, UGX 388 billion was disbursed in new funding during the year, supporting 770 active projects across 103 districts. The industrial sector remained dominant, accounting for 50% of the portfolio, with 46.8% in agro-industrialisation, 50% in manufacturing, and 3.2% in mineral-based industries.

Strategic Programmes and Innovation

UDB implemented several initiatives to address systemic growth barriers and broaden its development impact: BASE (Business Accelerator for Successful Entrepreneurs): Provided advisory and capacity-building to 450 SMEs, with a focus on youth and women. The Bank also incubated 71 early-stage businesses.

Project Preparation Facility invested UGX 5.1 billion to develop high-potential projects, including research for locally adapted sunflower seed varieties in agriculture. The Hybrid Electricity Connections Programme supported over 42,000 households and small businesses, improving access to energy, while the Ugandan Contractors Funding Initiative provided affordable capital to local contractors to boost their competitiveness and capacity.

Development Impact

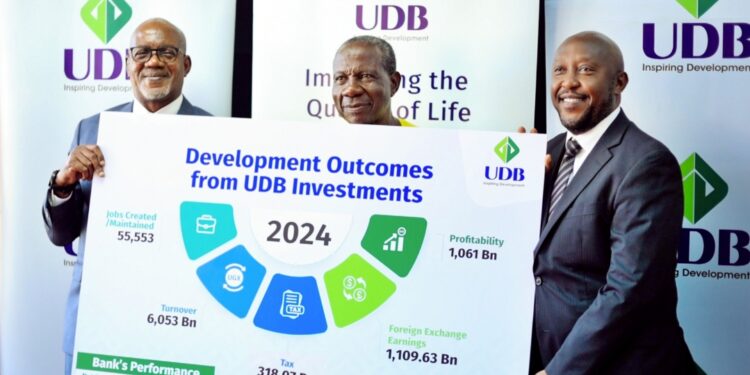

UDB-supported enterprises contributed significantly to national development in 2024: Jobs: 55,553 jobs were created and maintained, up 7.2% from 2023. Of these, 59.9% were youth, and 31.3% were women.

Output: Financed enterprises generated UGX 6.05 trillion in output, up from UGX 5.86 trillion in 2023. Profitability: UDB-supported businesses posted over UGX 1 trillion in profits, up from UGX 869 billion. Tax Contribution: Increased to UGX 316 billion, from UGX 236 billion in 2023. Foreign Exchange: Enterprises earned the equivalent of UGX 1.1 trillion in forex—up 17% from UGX 953 billion in 2023—with agro-processing and manufacturing being key contributors.

Operational Efficiency and Financial Health

UDB maintained its cost-to-income ratio (excluding impairments) at 31%, reflecting continued operational efficiency. Return on assets improved to 3.26%, while return on equity rose slightly to 3.89%.

“As UDB prepares for future impact, we are focused on optimising resources across all levels—financial, human, technological, and institutional—and exploring innovative funding to deepen our development footprint,” said Dr. Ojangole.

Leadership Commendation

The Minister of Finance, Planning, and Economic Development, Hon. Matia Kasaija, praised UDB for aligning its operations with national priorities: “UDB’s performance is a testament to what a well-run national development finance institution can achieve. Its role in delivering long-term capital to the private sector is critical to achieving Uganda’s development aspirations.”

“I am pleased that UDB’s 2024 interventions are aligned with the strategic objectives outlined in the country’s National Development Plan,” Hon. Kasaija said. “An efficient national development financing institution, such as UDB, is critical in realising our development goals as a country. Through UDB, the government continues to support private businesses by providing long-term and patient capital.”

Geoffrey Kihuguru, Chairperson of UDB’s Board of Directors, reaffirmed the Bank’s commitment to long-term sustainability through prudent asset management and efficiency in operations.

“In 2024, UDB stood resilient and responsive, capitalising on Uganda’s GDP growth of 6.4% to deepen impact across all regions,” he noted. “It was a year of prudent stewardship and transformational outcomes.”

He emphasised the role of institutional innovation, pointing to UDB’s incubation programme and project preparation initiatives as steps toward de-risking enterprise financing and enhancing SME competitiveness.