Stanbic Uganda Holdings Limited (SUHL), the parent company of Stanbic Bank Uganda and its affiliated entities—including SBG Securities, Stanbic Business Incubator, Stanbic Properties, and FlyHub—has posted robust financial results for 2024, with profit after tax (PAT) reaching UShs 478 billion.

The announcement was made during a press briefing in Kampala attended by top executives, clients, and stakeholders. Despite a turbulent global economic climate, Stanbic Uganda demonstrated resilience and agility, recording growth across key indicators.

“We are pleased with our performance in 2024, particularly given the complex external environment,” said Francis Karuhanga, SUHL’s Chief Executive. “Supportive fiscal and monetary policies, along with disciplined strategy execution, enabled us to stay focused on delivering value despite increased competition, especially from fintechs.”

Financial Highlights

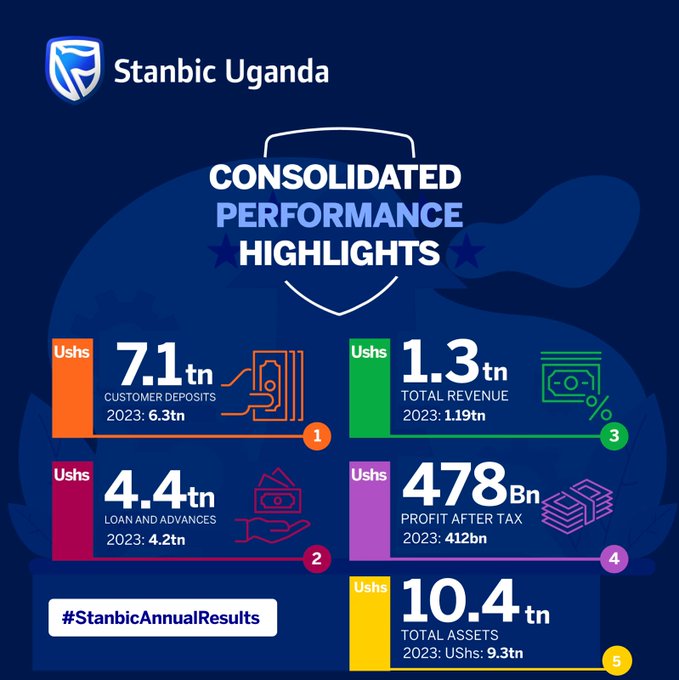

Ronald Makata, Chief Finance and Value Management Officer said the total revenue reached UShs 1.3 trillion, representing an 11.8% compound annual growth rate (CAGR), Operating expenses were managed at UShs 612 billion, resulting in a strong cost-to-income ratio of 47.2%, Profit after tax rose by 16.2% from the previous year to UShs 478 billion.

Customer deposits grew by 12.2% to UShs 7.1 trillion, Loans and advances increased by 3.5%, totalling UShs 4.4 trillion, maintaining a 19.5% market share and Non-interest revenue grew by 10.8%, supported by increased transaction volumes.

“We stayed committed to cost discipline and efficiency,” added Makata. “These results reflect our ability to adapt while driving sustainable growth.”

Dividends and Tax Contribution

In recognition of its strong performance, Stanbic Uganda has proposed a total dividend payout of UShs 300 billion for 2024. This includes UShs 140 billion paid as interim dividends in mid-2024, with a final dividend of UShs 160 billion pending shareholder approval. This marks a 7.1% increase in annual dividends.

Stanbic Uganda also paid UShs 427.8 billion in taxes, up from UShs 355 billion in 2023, reinforcing its position as the top taxpayer in the financial services sector. Its contribution supported the Uganda Revenue Authority (URA) in surpassing UShs 10 trillion in total collections for the year.

Driving Inclusive Economic Growth

Agriculture Financing

Stanbic continued to invest heavily in agriculture, disbursing UShs 454 billion in 2024, including UShs 96 billion to nearly 7,000 farmer SACCOs through its Economic Enterprise Restart Fund (EERF). Since its inception during the COVID-19 pandemic, the fund has provided UShs 170 billion in affordable credit, directly benefiting over 2.6 million smallholder farmers.

Empowering Women Entrepreneurs

Through the Stanbic4Her initiative, the bank disbursed UShs 94 billion in 2024 to 6,700 women-led businesses, up 54.5% from the previous year. Since 2022, UShs 173 billion has been extended through the program, with interest rates capped at 15.5%. Additionally, 3,400 women received training in business management and financial literacy.

Support for SMEs

Stanbic provided UShs 973 billion in credit to SMEs, including UShs 76 billion through the Stanbic Business Incubator, which supported over 3,000 enterprises. These businesses generated thousands of jobs, with each averaging seven new employees. The incubator also promoted formalization, helping 43% of participants register with URSB in 2024.

Looking Ahead

As it moves into 2025, Stanbic Uganda remains focused on sustaining growth and deepening its role in national development.

“Our commitment to financial inclusion, innovation, and delivering value to all our stakeholders is stronger than ever,” said Karuhanga. “We are confident that by staying the course on sustainable growth, we will continue driving Uganda’s economic transformation.”