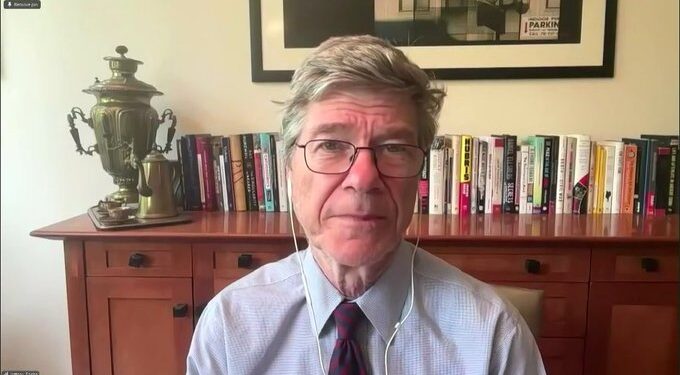

Munyonyo – Africa must focus on bold, investment-led strategies and mobilise capital flows to achieve rapid economic growth, rather than relying on development aid, Professor Jeffrey Sachs of Columbia University told participants at the Uganda Development Finance Summit 2025, held at Speke Resort Munyonyo.

“The debt is not too high; it is actually too low,” Sachs asserted, emphasising that Africa’s main challenge is not the volume of borrowing but its short-term nature. “The problem, however, is that the debt is short-term. Africa lacks creditworthiness and is only able to mobilise loans at three to five years from international capital markets. The result is that when the time is up, the economy hasn’t grown enough to service the debt,” he explained.

Sachs also criticised global financial institutions for prioritising short-term stability over long-term development. “Governments are involved in very short-term operations, many of them struggling to stay above the water. The International Monetary Fund (IMF) is not oriented towards long-term growth; it is oriented towards short-term fiscal stability. This needs to fundamentally change,” he said.

Africa’s development, Sachs stressed, should be driven by strategic investments in people, infrastructure, and business. “The most important investment is in the education and skills of young people. Every African country should ensure that all children complete at least upper secondary education. There is no shortcut. Africa’s population is very young; Uganda’s median age is about 16. This means half the country is in school, which presents an unprecedented opportunity to build a skilled workforce,” he said.

On infrastructure, Sachs called for continental integration. “Reliable electricity, transport networks including roads and rail, smart urban public transport, and high-quality digital access are essential. Everything—from healthcare and education to payments and government services—is online. Africa should aim for universal access to 5G networks and, eventually, beyond,” he added.

Private sector development, Sachs said, must complement public investments. “Private sector investments across agriculture, industry, and services cannot succeed without a skilled population and strong infrastructure. Mechanisation, information systems, drones for farmland management, and other innovations are vital, but they rely on complementary public investments.”

Regional and Continental Cooperation

He also highlighted the importance of regional and continental cooperation. “The success of each country is tied to its neighbours. Uganda’s prosperity depends on functional neighbours like Kenya and Rwanda. Regional integration and strong continental institutions are essential,” he said, stressing the role of the African Continental Free Trade Area (AfCFTA) and a strengthened African Union in fostering economic scale and coordination.

Sachs emphasised the importance of strong leadership in guiding Africa’s economic transformation and highlighted that the success of individual countries depends heavily on the effectiveness of their neighbours and regional institutions.

He noted: “A group of strong African leaders, President Museveni among them, should really bolster the institutions at the union level so that this could be a union-level program of action.”

Sachs’ point was that President Museveni, along with other influential African leaders, has a crucial role in strengthening the African Union and ensuring that regional cooperation, infrastructure integration, and investment-led growth strategies are implemented effectively.

He also framed this in the context of Uganda’s national success: “For every country, but especially a country like Uganda, the success of the neighbourhood is absolutely crucial for Uganda’s own national success. If Kenya and Rwanda are functioning well, Uganda benefits greatly.”

So, Sachs praised Museveni as a key figure whose leadership is important for both continental integration and Uganda’s economic development.

Aid Will Not Develop Africa

He, however, warned against letting concerns over debt and fiscal constraints derail long-term development strategies. “Africa’s debts are not too high; they only appear so relative to low GDP levels, not when measured against the continent’s vast potential. Do not let short-term fiscal stress get in the way of long-term thinking. Everything we do should aim at rapid economic growth and the investment strategy necessary to achieve it,” he said.

Sachs urged Africa to pursue financing from diverse sources, including China, India, and private capital markets. “Africa will not develop on the basis of development aid…It should depend on capital flows and private financing. We need an expanded African Development Bank that can include a private sector component, like an African International Finance Corporation (IFC),” he said.

New Strategy

He said that by 2050, Africa will make up 25% of the world’s population, placing the continent at the centre of the global economy in a way it has never been before. “Private capital will inevitably flow, but it should begin now through available quasi-public sources. Africa needs a strategy that does not depend on the US and Europe, but rather on capital flows, private financing, and partnerships with countries such as China, India, and others that are more forthcoming.”

While opening the summit earlier, President Museveni stressed that successful cities and industries need not only cheap money, electricity, and transport, but also markets.

“As a strategist, I can tell you that integration of the African market is a matter of life and death. Without a big market, you cannot grow. That is the difference between the United States and Latin America. Latin America has water, minerals, everything, but remains poor because of market fragmentation,” H.E. Museveni argued, saying that Uganda and other African countries must relentlessly pursue market integration, not just through rhetoric but through political will and decisive action.

He challenged international financiers to channel patient capital to Africa, noting that China had already demonstrated the viability of such investments in Uganda.

“With Chinese money, we built Isimba Dam and now produce electricity at 4.8 cents per kilowatt hour. With Karuma, we produce at 2.8 cents. When we finish paying the loans, the cost will fall to 1.2 cents. That is transformation. That is what development means,” President Museveni said.

President Museveni also highlighted the two qualities needed for Africa’s transformation, which are vision and integrity, saying that at independence, Uganda’s economy was producing only the three Cs and three Ts—coffee, copper, cotton, tobacco, tourism, and tea, where only 9% of households were in the money economy and 91% were outside.

“So, if you were a leader then, what was your vision? Policymakers must be like doctors—diagnose the disease, prescribe the cure,” he said, urging Ugandans to embrace saving and capital accumulation, stressing that development requires sacrifice and patience.

The summit, hosted by the Uganda Development Bank in partnership with international and regional stakeholders, brought together policymakers, financiers, academics, and industry leaders to discuss strategies for Africa’s socio-economic transformation.