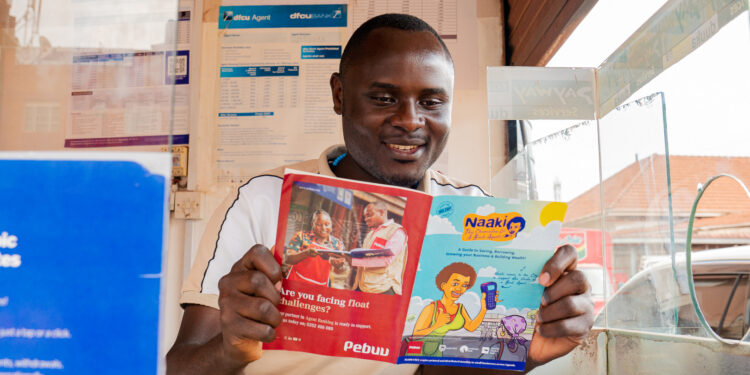

Pebuu Africa has unveiled Naaki: The Chronicles of a Bank Agent, a vibrant comic book designed to make financial literacy fun, relatable, and accessible for entrepreneurs and communities across Uganda.

Developed under the Pebuu Impact Initiative, the comic follows the adventures of Naaki, a curious and hardworking young woman with a touch of naivety — but plenty of charisma. Eager to learn and seize opportunities in Kampala, Naaki’s journey introduces readers to essential lessons in financial management, decision-making, and business planning, all delivered through storytelling that is as entertaining as it is educational.

“Naaki is more than just a fun comic book,” explains John Paul Ssemyalo, CEO of Pebuu Africa. “It is a financial literacy adventure.”

He notes that in many parts of Uganda, reading engagement and literacy levels remain low, while access to online materials is limited. Naaki seeks to close this gap by offering a printed, story-driven learning tool that communities can easily access. “With Naaki, we are piloting an edutaining design approach that blends engaging storytelling with practical lessons,” Ssemyalo says. “By offering a printed version, we ensure the book reaches readers in the communities where Pebuu operates, making learning both fun and relatable.”

Each month, 30,000 printed copies of Naaki will be distributed free of charge to bank agents, small businesses, and households across Uganda. Thanks to partnerships with banks and other organisations, the comic book will be available at no cost, maximising its reach and impact.

“We believe Naaki will be read not only by entrepreneurs but also by their children — circulating among neighbours, families, and even youth organisations working to build financial literacy and business skills,” Ssemyalo emphasises.

The launch edition marks just the beginning of Naaki’s adventure. Pebuu plans to translate the comic into local languages, expand its distribution to other African countries facing similar financial literacy challenges, and develop digital editions for online and social media platforms to reach even wider audiences.

But as Ssemyalo notes, the initiative goes beyond financial education. “Working on this comic book reminded us to think about the environment,” he says. “We realised that over a year, we would use nearly 2.9 million A5 sheets of paper to deliver the publication — and that’s without accounting for the energy, water, and carbon emissions linked to its production. So we launched the One Agent, 10 Trees campaign to offset this impact.”

Under this environmental initiative, Pebuu — together with bank agents, small business owners, local authorities, and community partners — plans to plant 500,000 indigenous trees by 2030 across Uganda.

“With this campaign, we highlight the intersection of sustainable business growth and environmental stewardship,” Ssemyalo says. “We want to show that profit generation can drive social impact while protecting the planet — but this must be a collective effort.”

Starting September 2025, Naaki: The Chronicles of a Bank Agent will also be available for digital download via the Pebuu website, with Naaki’s adventures continuing across platforms like Instagram to connect with children, adults, and entire communities.

With Naaki, Pebuu Africa aims to close financial literacy gaps while fostering cultural engagement, environmental sustainability, and community-driven impact through education that is entertaining, meaningful, and sustainable.