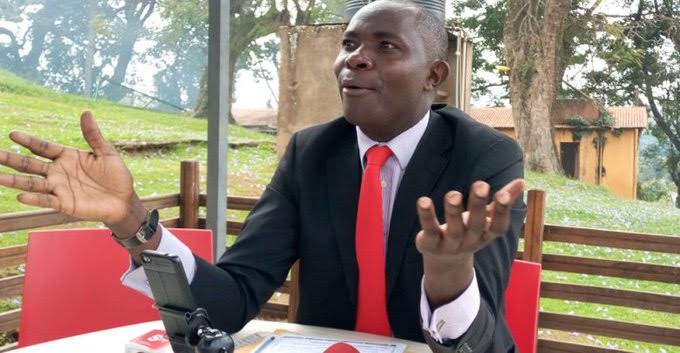

Lawyer Male Mabirizi has petitioned the High Court in Kampala seeking to quash the directive by the Uganda Revenue Authority-URA, requiring buyers and sellers of land worth 10 Million Shillings or more to have a tax identification number (TIN).

According to URA, the requirement is aimed at registering all the potential taxpayers and widening the current tax base.

In the petition before the Civil Division, Mabirizi is challenging the December 3 2021 directive issued by URA’s Manager for Business Analysis, Milly Isingoma Nalukwago indicating that effective December 6 2021, both the purchasers and sellers of land transacting at 10 million shillings and above are required to have TIN numbers.

However, Mabirizi has decided to challenge the directive on grounds that URA has no powers to compel a person who is not liable to pay tax to register for a TIN.

He argues that under the law, the registration for TIN is a voluntary decision not based on transaction amounts, and that stamp duty is a non-tax revenue and therefore it doesn’t require a TIN.

According to Mabirizi, the URA decision undermines the right to own property by Ugandans which is provided for in the Constitution and the directive further puts illegal barriers to the transfer of property contrary to the Tax Procedure Code Act.

Therefore to him, the directive is illegal, improper, and was unreasonably made beyond the powers and functions of URA.

Besides seeking orders to quash the directive, Mabirizi also wants the court to issue a permanent order restraining URA from implementing it as well as general, exemplary and aggravated damages for inconveniences caused to him as a result.

URA is yet to be summoned to defend itself over the allegations before the matter can be fixed and allocated to a Judge who will then fix it for hearing. URN