As the world continues to grapple with economic uncertainty, savvy investors are turning to East Africa as a lucrative investment destination. In 2025, the region is expected to experience significant growth driven by increasing demand for housing, tourism, and luxury vehicles.

According to a report by Knight Frank, the East African real estate market is expected to grow by 10% in 2025, driven by increasing demand for housing in cities such as Nairobi, Dar es Salaam, and Kampala. Investors who tap into this trend by purchasing plots or investing in land for sale can reap significant returns. For instance, a plot of land in Nairobi’s Karen suburb can cost anywhere from $500,000 to $1 million.

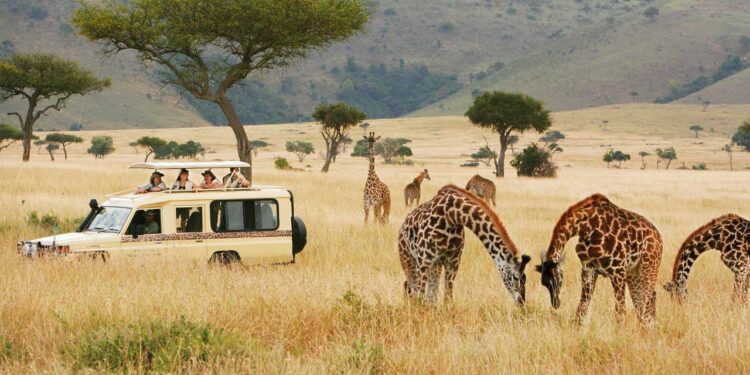

Furthermore, the growth of tourism in East Africa has created a surge in demand for luxury safari lodges and tour operators. Investors who develop or acquire properties with easy access to national parks and game reserves, such as the Masai Mara National Park in Kenya or the Serengeti National Park in Tanzania, can capitalize on this trend. According to the Kenya safari board, tourism revenues in Kenya are expected to reach $1.5 billion in 2025, up from $1.2 billion in 2022.

In addition, the demand for luxury vehicles in East Africa is on the rise, driven by increasing demand from affluent individuals and businesses. Investors who open dealerships for high-end brands such as Toyota, BMW, or Audi can attract a loyal customer base and generate significant revenue. The Toyota Prado, Toyota Cross, BMW X7, and Audi Q5 are just a few examples of luxury vehicles that are in high demand in East Africa.

According to a report by the East African Business Council, the demand for luxury vehicles in East Africa is expected to continue growing in 2025, driven by increasing demand from emerging markets. Investors who tap into this trend can not only reap significant returns but also establish themselves as leaders in the luxury vehicle market in East Africa.