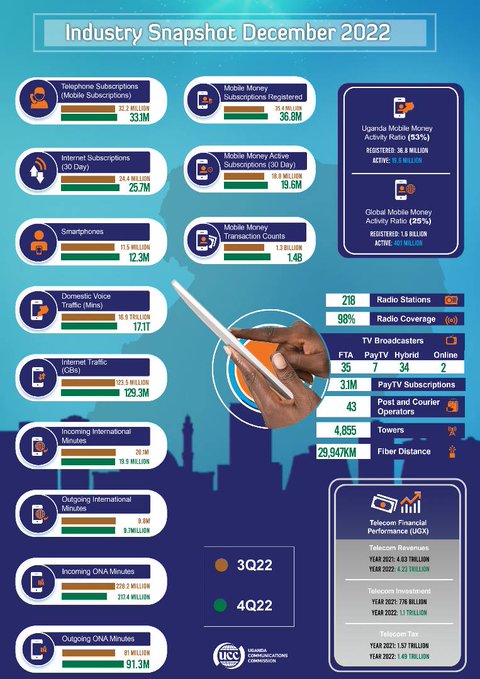

Uganda’s connectivity scorecard continued its positive trajectory in 2022, with total fixed and mobile subscriptions surging to an impressive 33.2 million by the end of the year. A total of 33.1 million of these were on mobile while 117,000 were fixed subscriptions.

Figures from the last quarter of 2022 show a 3% growth in subscriptions, indicating a continuous upward trend in subscription numbers since the start of the year, according to the Uganda Communications Commission (UCC) quarterly market performance report.

In the 12 months ending December 2022, the industry recorded a net addition of 2.9 million new mobile subscriptions, representing a 10% increase.

As a result of this growth in subscriptions, the national tele density in mobile subscription terms now stands at 77 lines out of every 100 Ugandans, irrespective of age.

On the other hand, total internet subscriptions crossed the 25 million mark with a net addition of 1.3 million subscriptions in the quarter and the highest quarter-on-quarter addition in 2022.

The growth in internet subscriptions was driven by the seasonal factor associated with internet packages and value propositions offered by the various Internet Service Providers (ISPs) during the end-of-year festivities.

Going by a year-on-year comparison, some 1.8 million new internet connections were recorded, resulting in a national penetration rate of 60%.

In terms of internet traffic, the year ended with 129.3 million GBs in use during the fourth quarter, surpassing the previous quarter by 5.8 million GBs.

This growth can be attributed to the end-of-year pricing and product promotions often associated with the festive season in both fixed and mobile internet segments. It is also worth noting that internet traffic has doubled since 2020, with mobile data contributing over 94% of total data traffic.

By the end of December 2022, a total of 30 million GBs of data from fixed internet traffic had been recorded, compared to 14.1 million GBs at the end of December 2020.

In mobile data terms, the industry recorded a total of 421.5 million GBs in use in 2022, which is double the 217 million GBs recorded in 2020, a clear indication that data is a key driver of the sector.

Mobile money

During the quarter under review, the market recorded 1.4 billion mobile money transactions, indicating a 4% growth. This trend is attributed to the increase in person-to-business (P2B) and person-to-person (P2P) mobile money services as customers continued to adopt cashless payment methods.

In comparison to the quarter ending December 2021, the industry experienced a net growth of 182 million transaction counts, indicating a 15% jump between December 2021 and December 2022.

Meanwhile, registered mobile money subscriptions hit 36.8 million at the close of December 2022, indicating that digital financial services continue to be the primary catalyst for financial inclusion in Uganda. This is a 4% growth in comparison to the preceding quarter.

Of the 36.8 million registered mobile money subscriptions, approximately 50% were transacted at least once a month. The quarter-on-quarter growth reported an additional 1 million new mobile money registered subscriptions. On a year-on-year comparison, the industry recorded a net addition of 4 million mobile money subscriptions, representing 12% growth.

Network devices

The number of network-connected devices kept pace with subscriptions, with over 900,000 terminals added to the tally in the fourth quarter of 2022. As of December 2022, 38.1 million devices were recorded on Uganda’s networks. This growth is characterised by the rise in smartphone adoption, with 770,000 new smart terminals across the networks.

It is noteworthy that 95% of the terminals in Uganda’s telecom industry can access the internet, suggesting a shift in consumer behaviour from using basic mobile devices to more advanced and feature-rich smartphones due to the advantages that internet connectivity offers.

At the end of December 2022, the share of internet-enabled gadgets had grown by 18% compared to the basic gadgets which have dropped by 43% since December 2021.

Elsewhere, in domestic telecommunication market news, the assets of troubled Uganda Telecom Limited (UTL) were acquired by a new entity known as Uganda Telecommunications Corporation Limited (UTCL) in a deal worth Shs 316 billion.

With the acquisition, UTCL now commands a portfolio of over 400 tower sites and an existing customer base. The acquisition has also paved the way for UTCL to introduce a range of fixed and mobile voice and data services as new value propositions.

On the space technology front, Uganda successfully launched its first satellite, PearlAfricaSat-1, to the International Space Station during the quarter under review. The country’s cube-type satellite was deployed into low earth orbit in December 2022, marking a significant milestone for Uganda’s space programme.

The satellite’s primary mission is to provide crucial research and observation data that will enable the development of solutions in weather forecasting, land and water bodies monitoring, mineral mapping, agriculture monitoring, disaster prevention, infrastructure planning, and border security.

Turning to broadcast, the last quarter of 2022 marked the conclusion of the radio licensing process with the approval of 218 radio broadcasters in the three months ending December 2022. The radio license renewal exercise, which is considered an essential component of the regulatory framework in the broadcasting space, aimed to ensure efficient and effective use of the radio frequency spectrum, while also promoting compliance with broadcasting standards. The process involved meeting various requirements, including technical, financial, and legal compliance.

Regarding the postal and courier sector, domestic mail volumes increased to 182,370 in the fourth quarter, up from 172,863 mail in the third quarter of 2022. This reflects a 5% quarter-on-quarter growth. This growth can be attributed to new licensees entering the courier market, triggered by the increased demand for door-to-door delivery by domestic e-commerce businesses using courier services for last-mile delivery.

On the international scene, tech billionaire Elon Musk, CEO of Tesla, finally acquired the social media giant Twitter for a staggering USD 44 billion. This acquisition marked the second highest in the tech industry during the year 2022, following Microsoft’s acquisition of Activision Blizzard for USD 68.7 billion in the first quarter.

Musk’s acquisition of Twitter, which has a follower count of 134.7 million, was delayed by disagreements with former executives of the tech giant following allegations that the subscription count of 450 million Daily Active Users (DAU) was inflated by spam or fake accounts.