Finance professionals have been tipped on ethical and responsible transition to mass adoption of Artificial Intelligence (AI) to derive sustainable long-term value.

Artificial intelligence (AI), in its broadest sense, is intelligence exhibited by machines, particularly computer systems.

“Waiters are in trouble, drivers are in trouble, accountants are in trouble. Anything repetitive is in trouble. In Uganda, it is true that accountants that are doing basic tasks, if they are repetitive, they are in danger,” said Collin Babirukamu, the Director of E-government Services at the National Information and Technology Authority – Uganda (NITA-U).

This during the ACCA Uganda Members’ Convention 2024 held at Speke Resort Munyonyo last week.

He added: “AI is not emotional. If an employer is to choose between you and an AI that does not sleep, fall sick, or eat, who would they choose? Anybody who is reskilling now, this is the best time to do it.”

According to him, data analysis is going to be major for accountants because things like predictive analysis for forecasting can now be done by AI which is coming to make it more efficient.

“Fraud detection is becoming key and AI can assist with this. AI can now monitor, detect, and quickly adapt to the changes so we need to embrace AI quickly. We have infrastructural limitations but that is a work in progress.”

He said Uganda has 60 masts which will cover the shadow areas in most of the Ugandan corners that have no access to network. He cited education and awareness as a second limitation to the adoption of AI.

“The more we begin to demystify AI and move this discussion to our curriculum, the better. The 3rd is regulation. Everybody is playing catchup. The European Union (EU) and Rwanda have just released policies, and Kenya has a draft. We are working towards an AI legislation but Uganda, like everybody, is playing catchup.”

Data centers

Emmanuel Mugabi, General Manager-Managed Services at Centenary Technology Services, said digital lending is now done using technology.

“There is an exchange of data, inadvertently, you are giving out your personal data from your contact details to how often you call your mother. Companies collect this information without your knowledge,” he said, adding:

“At Centenary Technology Services, we ensure that we do a data privacy protection assessment before onboarding any AI tools to ensure we remain within the ethical boundaries and compliant with the laws in place.”

Godfrey Sserwamukoko, General Manager at Radio Data Centre – Uganda, spoke on data infrastructure availability and sustainability saying that the difference between a human being and the AI engine is that it doesn’t forget.

“Therein lies the issue of data centers. The kind of data workloads are in two sets; data and inferencing where the largest workload is. At Raxio, what we do is we have data cooling systems, there are sensors in every corner of the room looking for sources of heat or cold and then we’re able to cool based on the information received.”

Sserwamukoko said they use water from a borehole and the atmosphere in Uganda which helps ensure the data center is cool at all times and that speaks to the sustainability question.

From a cash flow perspective, Sserwamukoko said their core location centers are affordable to customers in tiers and that’s how we make money.

Joel Muhumuza, Chief Executive Officer of flyhub, said they made a decision not to close our branches which would have been efficient but don’t want to leave out the customers that need their services.

“Some people still need access to customer care to make them feel at home. We are re-training our customer care teams to be relationship managers.”

Muhumuza said the other application was fraud. “When we purchased fraud detection software and when you use pre-fabricated templates, you start to vilify people who are not villains. Your best skill is that you can question the things that people like me build.”

Building Trust in AI Tools

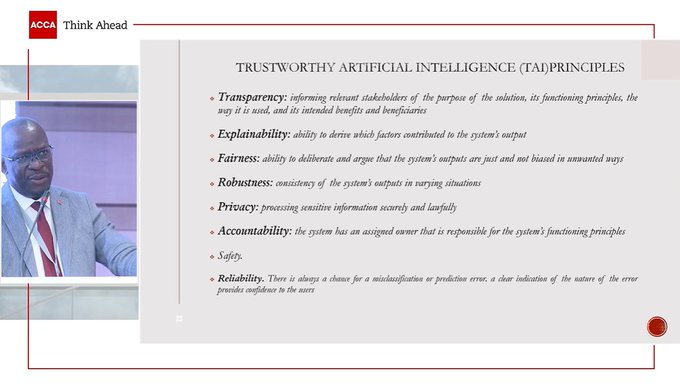

Hussein Isingoma FCCA, Commissioner of Forensics and Risk Management at the Ministry of Finance, tipped finance professionals on building trust in AI tools to be rolled out in their organizations.

“You now no longer need to be that tech savvy to understand AI. Things have been simplified. The ecosystem is important for us to know. As accountants, our role is to provide guidance and also provide assurance,” he said.

According to Isingoma, AI in design and advertising can bring accountants closer to ethical dilemmas. “So, as finance professionals, you need to be in the know. You need to understand the ecosystem, the roles, concerns, and application and how they can bring you to trust artificial intelligence.”

He added: “Goldman Sachs estimates that AI can replace 300 million jobs or 28% of the U.S. workforce. So as finance professionals, to what extent are we prepared or what are we preparing for?”