Over 550 small and medium enterprises (SMEs) from across Uganda gathered at Hotel Africana on Thursday for the official launch of the second edition of the Tupange Business Forum, Equity Bank Uganda’s flagship program designed to give entrepreneurs access to financing, mentorship, training, market opportunities, and business advisory services.

This year’s edition begins in Kampala and will roll out to Mbale, Arua, Hoima, and Fort Portal, with the aim of connecting entrepreneurs to a nationwide network of support.

Opening the event, Olivia Mugaba, Head of SME at Equity Bank Uganda, underscored the vital role of SMEs in driving economic growth. “SMEs run the world — they are the heartbeat of our economy, creating seven out of every ten jobs globally,” Mugaba said.

“At Equity Bank Uganda, we recognise their power and potential, which is why our focus is on financing integrated value chains, helping entrepreneurs manage cash flow, optimise operations, and unlock growth from the top anchor to the last mile. When we empower SMEs, we empower the nation.”

She thanked branch managers for their role in making the forum possible and encouraged SME owners to connect with each other, noting that relationships and shared experiences are essential for business success.

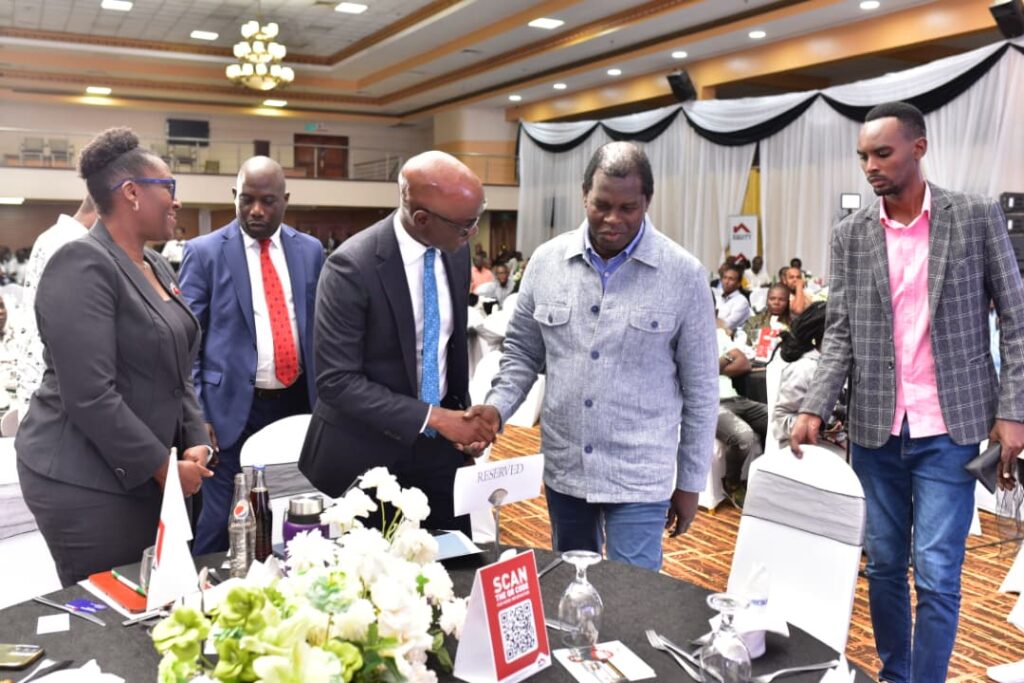

Claver Serumaga, Executive Director at Equity Bank Uganda, highlighted how the bank is using innovation to make banking more accessible and efficient for SMEs.

“At Equity Bank, we bring banking closer to SMEs — from agents and POS services to our soon-to-launch Pay with Equity platform, making daily cash flow and transactions seamless for business growth,” he said. “Through innovations such as real-time payments, bulk salary processing, and unsecured supplier financing of up to UGX 1.5 billion, we continue to invest in solutions that enable sustainable business growth.”

Serumaga stressed that Equity Bank views every SME as part of a broader value chain. “By supporting your entire ecosystem and remaining fully accountable to our clients, we ensure that as your business expands, Equity Bank grows alongside you,” he added.

Guest speaker Pastor Robert Kayanja commended the bank’s commitment to communities and social enterprises. “Equity Bank is more than a financial institution — it’s a partner that cares for people,” Kayanja said.

“In Karamoja, they stood with us in our fight against hunger, financing tractors and agricultural projects that have transformed communities. Their support proves that with the right partner, SMEs and social enterprises can thrive, and together we can create sustainable solutions that change lives.”

Delivering the keynote, Dr. Fred Muhumuza, Economic Advisor to the Minister of Finance and Director of the MUBS Economic Forum, called for SMEs to focus on their entire value chain.

“In business, your success is tied to every link in your value chain. If the person who supplies you or buys from you struggles financially, you will feel it too,” Muhumuza said. “From the farmer in the village to the trader in the market, everyone is part of a value chain. Equity Bank connects and supports each link, making sure SMEs can grow sustainably and seize every opportunity.”

The day also featured a panel discussion on “Beyond Banking: What Really Takes SMEs to Scale” and concluded with awards recognising outstanding entrepreneurs.

Fast and Furious Awards: Falkan Investments Ltd (Business Influencer Award), Bento Uganda Ltd (Ecosystem Award), Baigana Alex (Loyalty Award).

Dignet Awards: Scopio Africa Ltd (Influencer Award), J & L Industries (Ecosystem Award), Apple Properties (Loyalty Award).

The Tupange Business Forum is part of Equity Bank’s broader mission to integrate financial services with mentorship, training, and market access, ensuring Uganda’s SMEs have the tools to scale and contribute to the country’s economic transformation.