Equity Bank Uganda has reaffirmed its commitment to inclusive development and sustainable growth through a wide-ranging set of initiatives aimed at transforming lives, protecting the environment, and empowering future generations.

Under the banner “Green Growth in Action,” the Bank has planted 30,118 trees and invested UGX 22.25 billion in financing green enterprises—demonstrating its leadership in environmental stewardship and natural resource conservation.

Transforming Agriculture from Subsistence to Agribusiness

In a bid to boost Uganda’s agricultural productivity, Equity Bank has equipped over 96,000 farmers with financial literacy skills and disbursed UGX 127.9 billion in financing. The move is part of a broader strategy to transition smallholder farmers into agribusiness entrepreneurs.

Empowering Youth Entrepreneurs and Future Leaders

Equity Bank has also invested heavily in youth empowerment. In 2024, UGX 107.25 billion was disbursed to support young entrepreneurs, while the Equity Leaders Programme (ELP) continued to mentor Uganda’s brightest students.

The current Cohort 4 of ELP scholars is undergoing leadership and career development training at African Bible University in Lubowa. They even took off some time to dance and sing alongside Equi-Life ambassador Nakiyingi Veronica Lugya aka Vinka.

ELP annually selects the top boy and girl in UACE from each district with an Equity Bank branch, offering them mentorship, paid internships, and pathways to global university scholarships, including Ivy League institutions.

Social Protection for Refugees and Vulnerable Communities

In a robust display of social responsibility, the Bank has supported over 132,000 refugee households through cash transfers, social programmes, and business financing. To date, 366 refugee-owned businesses have been financed, with a total of UGX 277.19 billion disbursed to enhance resilience and restore dignity among displaced communities.

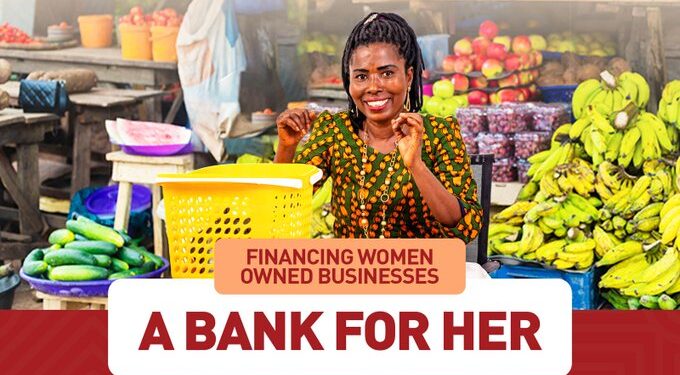

Unlocking Opportunities for Women Entrepreneurs

In 2024, Equity Bank prioritised women-led enterprises through targeted training, mentorship, and access to financing. The Bank disbursed UGX 9.79 billion in unsecured financing and trained 29,220 women entrepreneurs, reinforcing its mission to be “A Bank for Her.”

A Growing Footprint

Equity Bank’s 2024 milestones were supported by a growing network of over 2.2 million customers, 9,346 EquityDuuka agents, 2,522 merchants, and 58 ATMs across the country.

“We are proud of the impact we’re making together with our customers and partners. These achievements are more than numbers—they represent transformed lives and a brighter future for Uganda,” the Bank stated in a tweet on May 2.

As Equity Bank continues to expand its reach and deepen its impact, it remains a key player in driving sustainable, inclusive growth across Uganda’s financial, social, and environmental landscape.