The committee on Commissions, Statutory Authorities and State Enterprises (COSASE) has released its report following a four-month-long probe into the closure of seven defunct banks by Bank of Uganda (BOU).

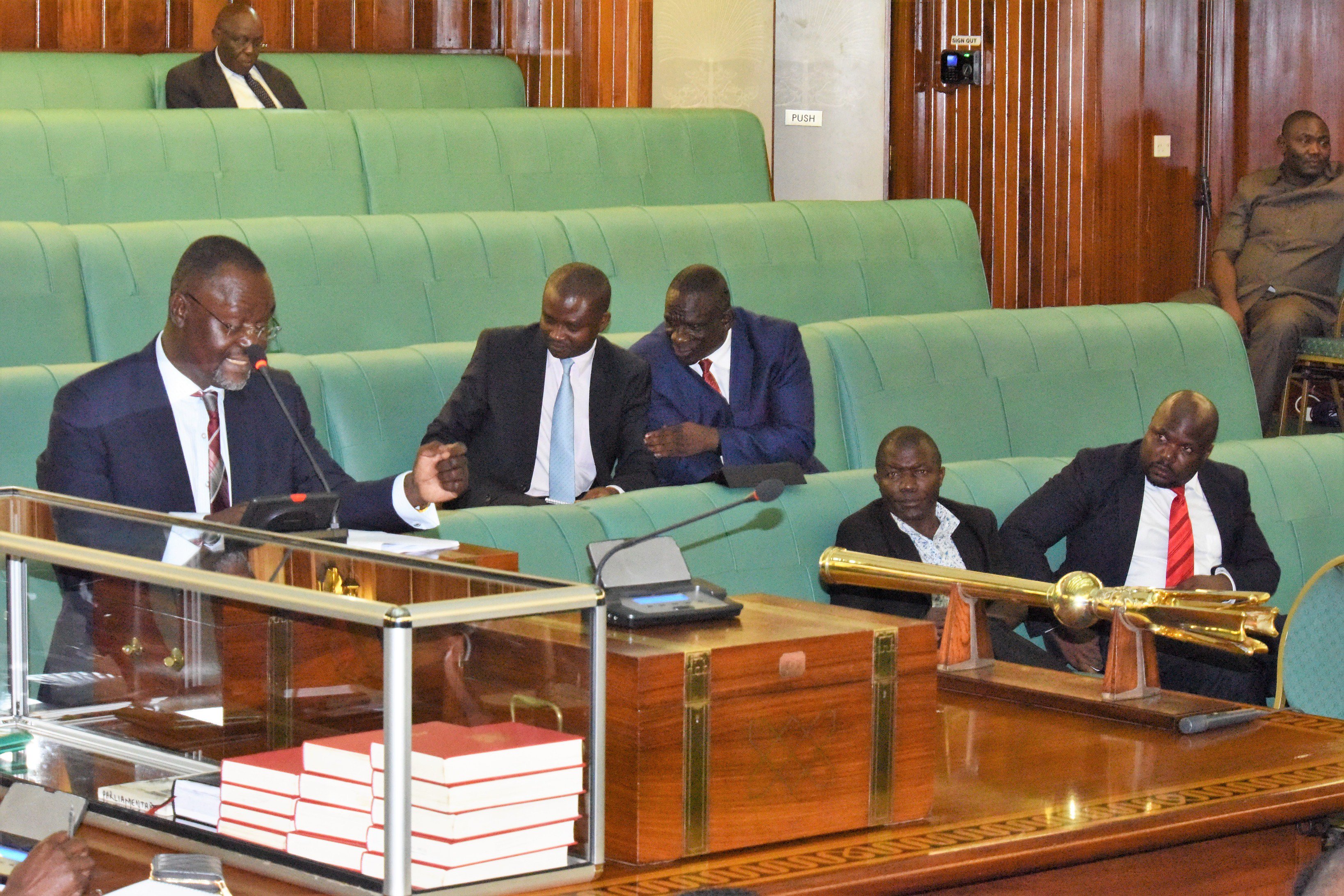

The report which was tabled before Parliament on Thursday evening faults the Central Bank for breaching the law and management standards in closing of the seven commercial banks.

In the report presented by committee Chairperson, Abdu Katuntu, COSASE recommended that all central bank officials who failed to properly execute their duties in accordance to the law be held accountable.

The former Executive Director of Bank Supervision at the Central Bank, Justine Bagyenda and Director for Financial Markets Development Coordination, Benedict Ssekabira were found to have mishandled the process of the closure of the defunct banks.

Katuntu reported that Bank of Uganda failed to value the assets and liabilities of Global Trust Bank, National Bank of Commerce and Crane Bank Limited and caused the lapse of time and impossibility in revaluation of assets.

As such, COSASE has recommended that Bank of Uganda addresses the probable financial loss occasioned.

The committee noted that BOU officials did not keep the asset movement ledgers and all records relating to the liquidation of the three financial institutions in distress which include ICB, Greenland, Co-operative Bank whose liquidation started under the Financial Institutions Statute, 1993 and continued under the financial intelligence Authority 2004.

The Committee has also urged government to consider amending the Financial Institutions Act (FIA), 2004 to provide a time limit within which liquidation of financial institutions in distress should be concluded.

COSASE further recommended for the Central Bank to rectify errors committed on Greenland Bank’s Statement of Affairs for proper financial reporting and also take full responsibility of any probable loss of the Bank.

The committee observed that there are no documents relating to the post-closure and management of Teefe Trust Bank assets and liabilities.

The report further indicates that winding up the process of all the defunct banks has taken an unjustifiably long time causing a delay in settling of creditor claims. This was especially in reference to Teefe Trust Bank which was closed 26 years ago, Co-operative Bank (20 years), International credit Bank (21 years), Greenland Bank (20 years), National Bank of Commerce (7 years), Global Trust Bank (5 years) and Crane Bank Limited (2 years).

The committee has also tasked government to separate the supervisory and liquidation functions of Bank of Uganda, to avoid the likelihood of conflict of interest which Katuntu said might be a risk to the financial sector.

The report also recommends that Bank of Uganda ends the winding up processes of all defunct banks within a period not exceeding one year.