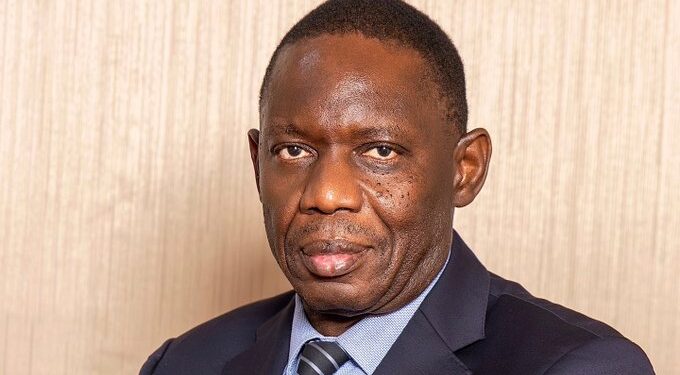

The Governor of the Bank of Uganda (BoU), Michael Atingi-Ego, has attributed the Ugandan shilling’s sustained appreciation over the past 14 months to strong economic fundamentals, not central bank intervention.

Speaking in Kampala, Atingi-Ego clarified that the BoU has not stepped into the foreign exchange market since mid-2022.

“The currency has indeed appreciated for about 14 months. But let me clarify—the Bank of Uganda did not intervene during that period. Our last sales-side intervention was in June 2022,” he said.

According to the Governor, multiple factors have contributed to the currency’s strength. “We have recorded strong exports, particularly coffee and cocoa, supported by higher global prices and increased volumes. For example, coffee exports alone earned us slightly over $2 billion in the last financial year,” he noted.

He added that prudent monetary policy has been instrumental in sustaining confidence in the economy. “Our disciplined approach has kept inflation low and stable. This, in turn, has attracted offshore investors into government securities, bringing in more foreign exchange,” Atingi-Ego explained.

The Governor further pointed to reforms in the foreign exchange market, including improvements in the swap market, which have reduced pressure on the spot market. He also cited global dynamics, particularly the weakening of the US dollar, as another factor boosting the shilling.

While some exporters have raised concerns that a stronger shilling could reduce competitiveness, Atingi-Ego stressed the importance of maintaining market discipline. “It is important to remember that the exchange rate is market-determined. Supporting exporters artificially would risk inflation and higher interest rates. Our focus is preserving stability without distorting fundamentals,” he said.

The BoU Governor concluded by emphasising that the appreciation is a reflection of solid fundamentals rather than temporary interventions. “The exchange rate is market-driven. What we are seeing is a strong currency underpinned by real economic performance,” he said.