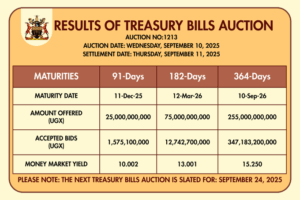

The latest Treasury Bills Auction No.1213 by the Bank of Uganda (BoU) recorded strong investor interest across all maturities, with total bids far exceeding the amounts on offer.

According to results released by BoU, bids worth UGX 597.09 billion were submitted against the UGX 355 billion on offer for the 91-day, 182-day, and 364-day Treasury Bills.

The auction results showed rising yields across all maturities, reflecting tighter liquidity conditions and strong demand for higher returns by investors.

For the 91-day tenor, the cut-off price was 97.567, translating into an annualised discount rate of 9.759% and a money market yield of 10.002%. Total bids received stood at UGX 46.53 billion, nearly double the UGX 25 billion on offer. However, only UGX 1.58 billion worth of bids were accepted.

The 182-day Treasury Bills attracted UGX 86.5 billion in bids against an offer of UGX 75 billion. The cut-off price settled at 93.912, giving an annualised discount rate of 12.209% and a money market yield of 13.001%. Accepted bids amounted to UGX 12.74 billion.

The largest volume was recorded in the 364-day tenor, with UGX 464.06 billion tendered against UGX 255 billion offered. The cut-off price was 86.799, corresponding to an annualised discount rate of 13.237% and a money market yield of 15.250%. Accepted bids totalled UGX 347.18 billion, representing the highest allocation of the auction.

The bid-to-cover ratios — which measure the level of demand relative to the amount offered — stood at 29.54 for 91-day, 6.79 for 182-day, and 1.34 for 364-day maturities, showing particularly strong competition for the shorter-term paper.

BoU confirmed that the next Treasury Bills Auction is scheduled for September 24, 2025.