Abidjan, Côte d’Ivoire — The 2025 edition of the Africa CEO Forum has concluded in Abidjan, leaving behind a seismic impact across the continent’s business and policy landscape.

Hailed as the forum’s “most unforgettable edition yet,” this year’s gathering shattered attendance records, drew delegations from over 70 countries, and laid the groundwork for transformative alliances, groundbreaking debates, and visionary strategies to propel Africa into a new era of leadership, investment, and innovation.

With over 70 sessions held across two dynamic days, the forum drew more than just numbers—it drew ambition. From state leaders to tech entrepreneurs, from global investors to grassroots changemakers, the message was resoundingly clear: Africa is ready to lead—on its own terms.

Integration, Innovation, and Industrialisation

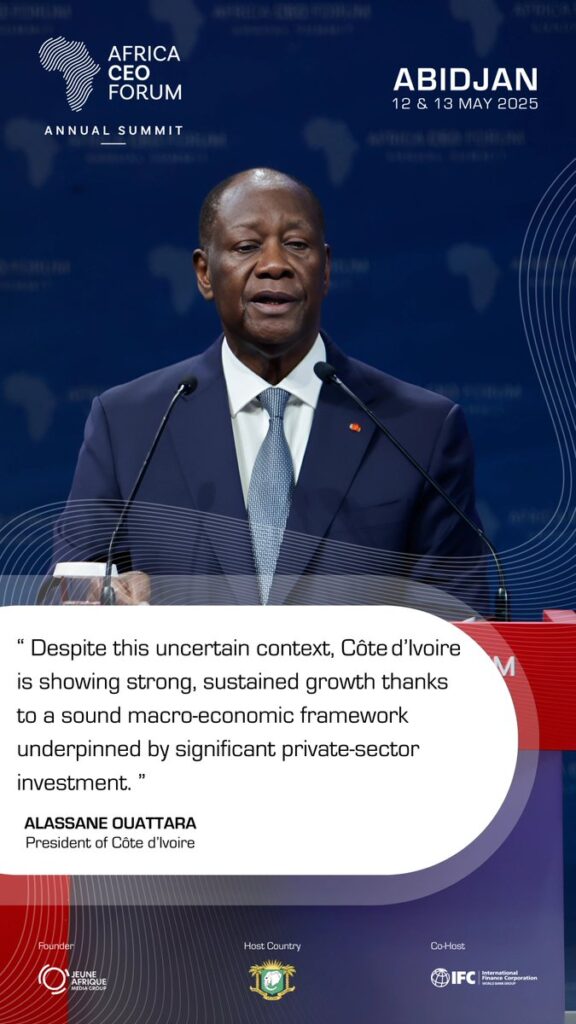

In his opening keynote, President Alassane Ouattara of Côte d’Ivoire set the tone for the summit, emphasising the urgent need for deeper intra-African trade, value addition through raw material processing, and full implementation of the African Continental Free Trade Area (AfCFTA).

“This must be a moment of truth and commitment,” he said, urging attendees to co-create “concrete and ambitious solutions.”

Sovereign Digital Future: Africa Charts Its Own AI Path

A standout session titled “Frugal or Prodigal AI: What is the African Model?” sparked one of the forum’s most urgent and insightful discussions. Experts, including Catherine Muraga, the Managing Director of Microsoft Africa Development Centre (ADC), and Geoffrey Odundo (CEO, Nairobi Securities Exchange) unpacked the realities of building AI systems that are resource-aware yet boldly innovative.

“Africa doesn’t need to copy. It needs to lead—intentionally,” said moderator Manal Bernoussi, emphasising a shift toward digital sovereignty that values resilience, data ownership, and regulatory autonomy.

On her part, Catherine Muraga emphasised a vision of AI grounded in Africa’s unique resource realities, yet bold in ambition. “Africa does not need to mimic the AI models of the West (scale-driven like the U.S.) or China (frugal by necessity). Instead, Africa can develop intentional, purpose-built AI solutions focused on local challenges such as agriculture, health, education, and small business empowerment.”

She advocated for actionable AI for African businesses, highlighting the importance of AI that works for small and medium enterprises (SMEs)—tools that are affordable, adaptable, and aligned with local infrastructure constraints.

She further stressed the need for sovereign digital infrastructure, data governance, and inclusive policy frameworks that empower Africans to control and benefit from their data. The discussions culminated in a resounding call for Africa to define its technological trajectory—one grounded in local contexts, but globally competitive.

Capital With Patience, Impact With Scale

Another high-level roundtable explored the future of development finance under the theme “Patient Capital, Scalable Impact.” Moderated by Mezuo Nwuneli of Sahel Capital, the session included leaders from the World Bank, Shell Foundation, and Swedfund.

Discussions focused on reimagining the role of private capital in financing social impact, transitioning from grants to growth capital, and the challenge of balancing philanthropy with return on investment. “Bankable development is not about short-term returns—it’s about shared value and long-term credibility,” one panellist noted.

Africa’s Mining Wealth: Rules, Returns, and Reforms

In one of the most high-stakes industry sessions, experts tackled the hot-button issue of African mineral wealth governance. With countries like Côte d’Ivoire reviewing mining codes and companies under pressure to support local processing, the debate centred on a crucial question: Can tougher national policies deliver real returns without driving away investors?

Representatives from Rio Tinto and national mining authorities discussed the balance between sovereignty and sustainability, urging transparency, shared benefits, and redefined investment frameworks.

Family-Owned Businesses: From Survival to Legacy

In a candid and forward-looking exchange, Aigboje Aig-Imoukhuede and Acha Leke of McKinsey reflected on the rise of family-owned African enterprises. “We must build institutions, not just businesses,” they stressed, advocating for structured succession, robust governance, and strategic philanthropy to turn legacy companies into intergenerational economic engines.

Ghana and Senegal Chart Bold National Strategies

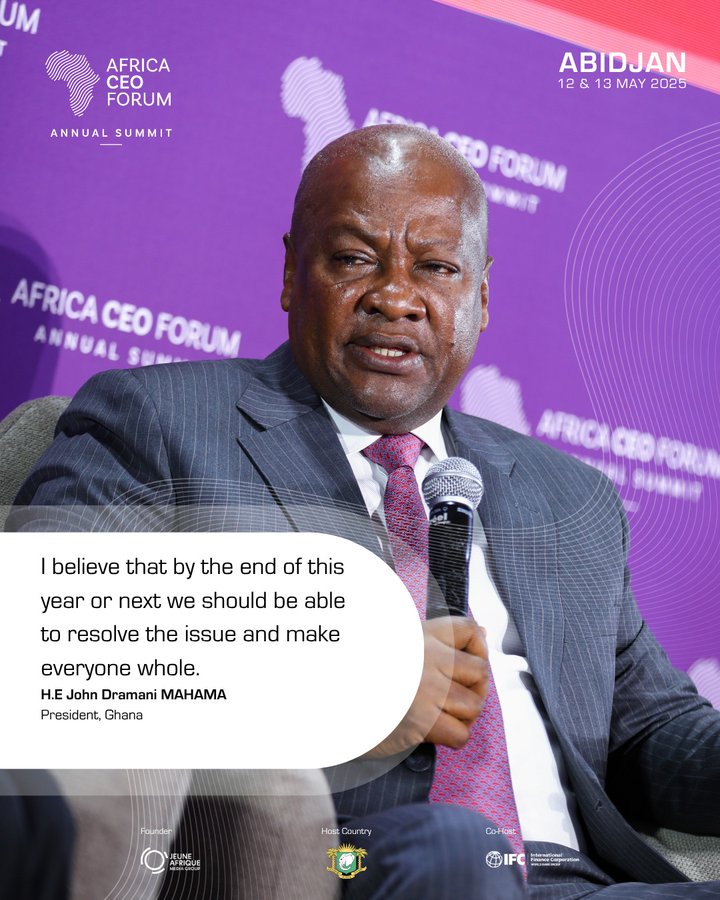

In exclusive sessions, President Bassirou Diomaye Faye of Senegal and President John Dramani Mahama of Ghana laid out visionary blueprints for their countries’ digital and energy futures. Faye made a compelling case for digital sovereignty, calling for independence from foreign tech platforms and infrastructure control.

Meanwhile, Mahama revealed Ghana’s dual-pronged strategy: advancing a $60 billion petrochemical hub while investing heavily in renewables through a new Renewable Energy Investment Fund. From bauxite and manganese to lithium, Ghana’s ambition is clear: to move beyond raw exports and build local value chains.

Are Sovereign Ratings Failing Africa?

A hard-hitting panel moderated by Ramah Nyang (CGTN Africa) brought long-standing grievances to the surface. Stanislas Zézé (Bloomfield) and Marie Diron (Moody’s) clashed on whether Africa’s credit ratings reflect real economic risks or systemic bias. The conclusion: scrutiny must lead to reform, and reform must begin with fairness.

As the dust settles on #ACF2025, the message reverberates continent-wide: Africa is no longer content to be a participant in global transformation. It seeks to be an architect of its future. From AI and energy to trade, capital, and leadership, this year’s Africa CEO Forum didn’t just talk change—it forged it.