Stanbic Uganda Holdings Limited, the holding company for among others, Stanbic Bank Uganda, Uganda’s largest bank Friday released its H1 2023 performance result reporting especially impressive growth in gross revenues and net profit.

Stanbic Uganda Holdings Limited (SUHL) is part of the Standard Bank Group, Africa’s largest Bank measured by footprint and assets. It reported a 23.5% rise in profit after tax for the first half of 2023.

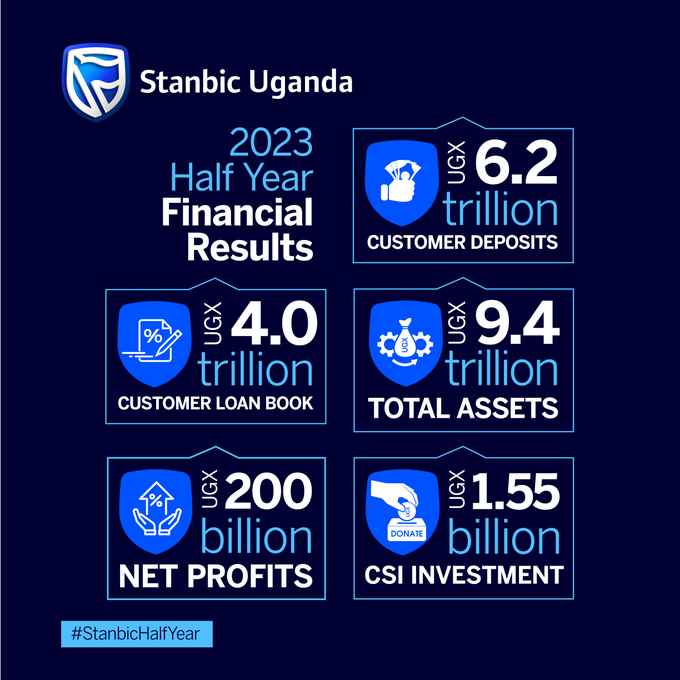

According to Anne Juuko, the Chief Executive of Stanbic Bank, the leading lender posted a resilient double-digit growth in revenue, with a Profit after Tax amounting to Shs200bn for the period ending 30 June 2023.

The customer deposits amounted to Shs6.2 trillion (1.1%), net customer loans Shs4.0 trillion (4.2%) and total revenue of Shs590bn (24.2%).

While releasing the half-year results Friday at Kampala Serena Hotel, Anne said Stanbic innovatively recalibrated credit extensions, extending loan repayment periods to 84 months.

“This has empowered households and businesses to navigate the challenging environment. With financial growth in key areas, our commitment remains steadfast,” she noted.

She said the economic recovery may be below expectations, but Stanbic Bank is rising to the occasion.

“Our innovative strategies are enabling businesses to thrive in tough times. Cybersecurity is paramount for Stanbic Bank. We led a multi-sector Financial Fraud Forum and are employing stringent measures to ensure the highest ethical standards in secure banking services.”

She said Stanbic Bank recognizes the importance of specialized solutions.

“In 2023, we have increased unsecured financing for educational institutions and continuously tailored responses for the agriculture sector. Together, we are building a resilient and prosperous Uganda.”

According to her, the growth of FlexiPay has been phenomenal, exceeding 700,000 users and a 400% growth in transactions.

It’s more than a platform; it’s a step towards a more inclusive financial environment in Uganda, Anne revealed.

“Our commitment to secure banking is unwavering. Through education, collaboration, and internal policies, we are ensuring that financial services are rooted in safety and ethics. Trust and integrity are at the heart of everything we do at Stanbic Bank.”

Diversification is key to growth

On his part, Andrew Mashanda, Stanbic Uganda Holdings Chief Executive, said from banking to real estate, Stanbic Uganda Holdings is on the rise.

“Diversification is key to our growth, and we are committed to driving Uganda’s future,” he noted.

While giving an overview of the macro-economic environment, Mashanda said the bank innovatively recalibrated credit extensions, extending loan repayment periods to 84 months and offering up to 75 days grace period before the first loan instalment.

“Our beyond banking businesses are on a positive trajectory.”

He said they overcame challenges and the half-year results showcase the bank’s resilience, driven by innovation, diversification, and unwavering commitment.

“Supporting SMEs, pursuing key projects, and leading the digital transformation—Stanbic Uganda Holdings is a name synonymous with growth and excellence,” he noted.

He said that they also strengthened their partnership with the Ministry of Health with the launch of the Uganda Corporate Society for Safe Motherhood which unites corporations to mobilize resources, aiming to significantly reduce maternal and infant mortality in Uganda.

“We continued the youth skilling initiative, the Stanbic National Schools Championship and the 2023 season has reached 100 schools, 60,000 students, and 100 teachers.”

He added: “Stanbic Bank proudly takes part in the “#TaasaObutonde” campaign and we were honoured by the government for our efforts towards finding solutions to combat the challenge of plastics pollution. Uganda’s future is green!”

He said the report highlights the bank’s positive impact through Corporate Social Investment (CSI) programmes, empowering financial inclusion, job creation, and development in critical public sectors.

“Shs149 billion has been paid in taxes. We are proud of our contribution to the country’s revenue collection target.” The company will also pay Shs125 billion in interim dividend, upon regulatory approval.