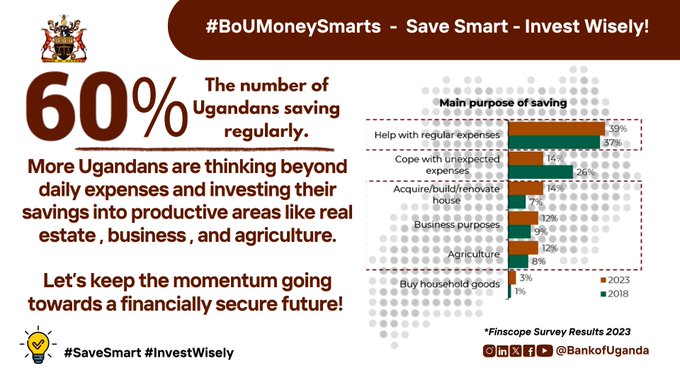

Uganda’s savings culture is on the rise with more Ugandans investing in their future, according to the FinScope Survey 2023 Report.

The report says 60% of Ugandans actively save, however, only 39% and 14% save to meet regular expenses and emergencies, respectively.

“For savings to truly make an impact, it’s fundamental for individuals to align savings with specific financial goals,” reads the report.

The Bank of Uganda (BoU) is encouraging the public to live the commitment by saving consistently, investing sustainably, and spending wisely.

The call is contained in a statement released by Kenneth Egesa, the Director of Communications & Public Relations, ahead of this year’s World Savings Day.

“By doing so, achieving these goals becomes a pathway to gradual improvement in both personal and household financial well-being. Therefore, it’s important to have goal-oriented savings plans, which can be facilitated by modern tools like automated savings apps and digital savings platforms such as mobile and internet banking,” reads the statement.

This year’s theme, “Sustainability & Personal Finance – Living the Commitment”, emphasizes the need to align financial decisions today, with long-term sustainability principles and ensure that personal finance practices not only secure individual financial well-being, but also contribute to broader social, environmental, and economic stability objectives.

According to BoU, financial sustainability calls for intentional choices that go beyond short-term gains. It includes developing habits that foster resilience, responsible consumption, and thoughtful investment in sustainable projects.

“Whether through sustainable spending, ethical investment or debt management, individuals can ensure that their financial decisions support their wellbeing whilst minimizing or ameliorating the impact of these decisions on the welfare of their communities.”

The bank says these innovations make it easier for individuals to allocate, track, and achieve savings targets.

“Encouraging a savings culture built around clear objectives can enhance financial resilience and help Ugandans better manage both expected and unforeseen expenses.”

To commemorate World Savings Day, the Bank of Uganda together with other financial sector stakeholders dedicated November 2024 as the Banking and Financial Services Awareness Month.

“The rationale for this action is to raise awareness about savings, improve attitudes toward financial services, and promote better financial decision-making behavior among individuals. Several activities have been lined up, including financial literacy talks and green awards,” noted the central bank.